The Payment Card Industry Data Security Standard (PCI DSS) is a global standard that outlines the minimum security requirements for businesses that handle credit card information. The standard was created to ensure that businesses have a secure system in place to protect their customers’ payment card data. In Singapore, the Monetary Authority of Singapore (MAS) requires all financial institutions and merchants to comply with the PCI DSS.

The PCI DSS consists of 12 requirements that businesses must meet in order to be compliant. These requirements cover a variety of areas, including network security, access control, data encryption, and monitoring and testing. The requirements are designed to protect against common security threats, such as data breaches, malware, and unauthorized access.

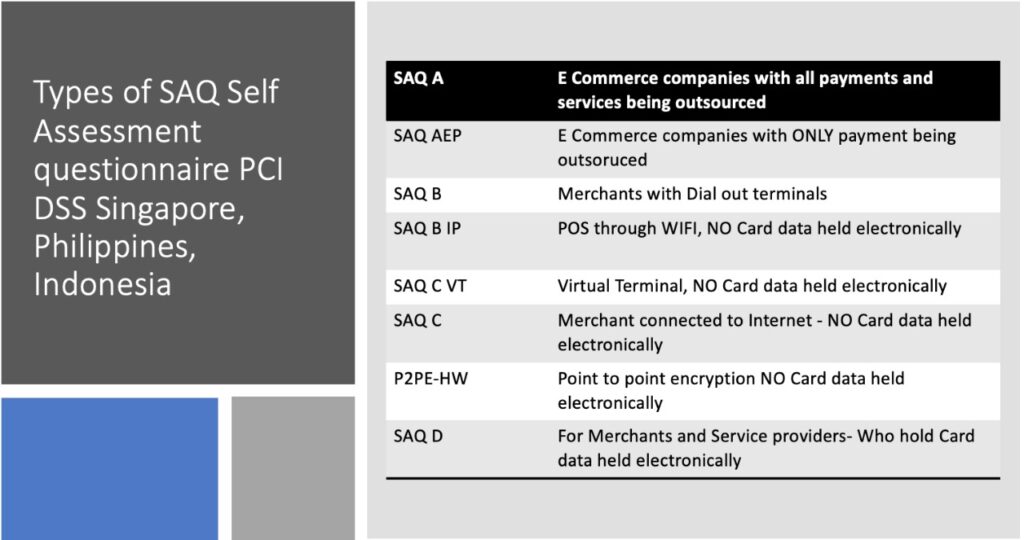

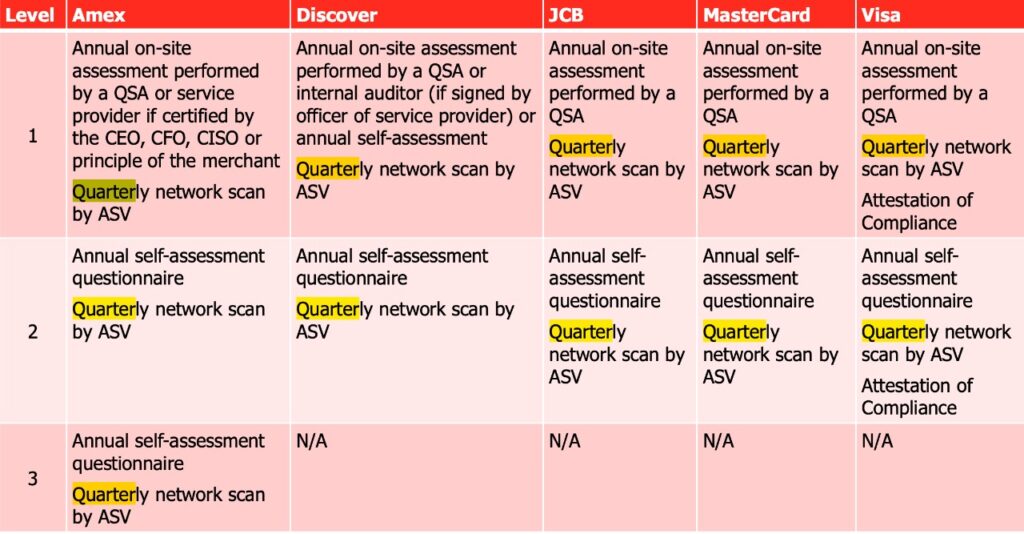

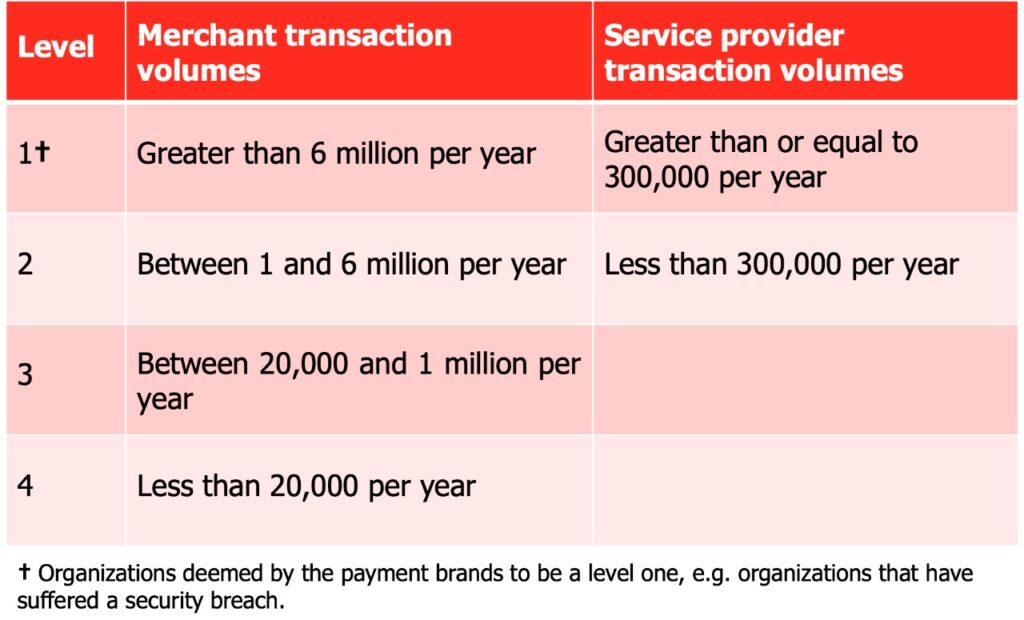

To comply with the PCI DSS, businesses in Singapore must first determine their level of compliance. This is determined by the number of credit card transactions processed annually. Level 1 is the highest level of compliance and is required for businesses that process more than 6 million transactions annually. Level 2 is required for businesses that process between 1 million and 6 million transactions annually, and Level 3 is required for businesses that process between 20,000 and 1 million transactions annually.

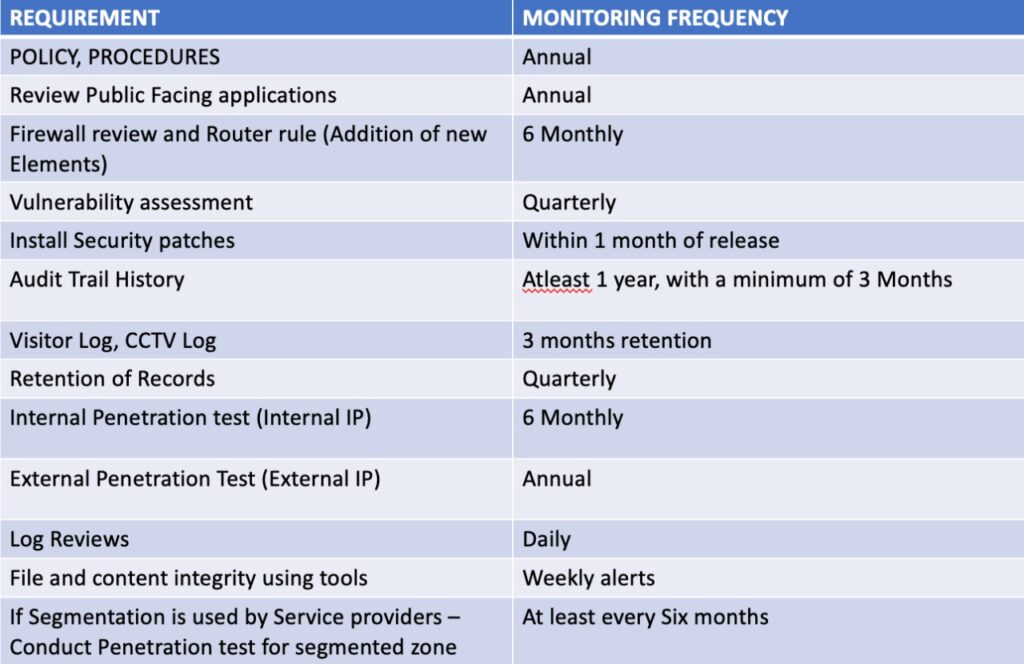

Once a business has determined its level of compliance, it must implement the necessary security measures to meet the requirements of the PCI DSS. This may include installing firewalls, encrypting data, and implementing access controls. Businesses must also conduct regular security assessments and audits to ensure that they remain compliant.

Failure to comply with the PCI DSS can result in fines and other penalties. In Singapore, the MAS may impose fines of up to S$1 million for non-compliance. In addition to financial penalties, businesses that fail to comply with the PCI DSS may also suffer damage to their reputation and loss of customers.

While the PCI DSS can be challenging for businesses to implement, it is an important standard for protecting customer data and maintaining the integrity of the payment card industry. In Singapore, the MAS has taken a proactive approach to enforcing the PCI DSS and ensuring that businesses are compliant. This has helped to establish Singapore as a secure and reliable destination for international business.

In addition to complying with the PCI DSS, businesses in Singapore should also consider implementing additional security measures to protect against emerging threats. This may include implementing multi-factor authentication, conducting regular vulnerability scans, and training employees on cyber security best practices.

In conclusion, the PCI DSS is an important standard for businesses in Singapore that handle credit card information. Compliance with the standard is required by the MAS and is essential for protecting customer data and maintaining the integrity of the payment card industry. While implementing the necessary security measures may be challenging, it is an important investment in the long-term success and reputation of a business.

For More Information drop an email to [email protected]

Services Offered :- Singapore, Australia, New Zealand , Penang, Batam , Hongkong, Manila, Batangas, Laguna, any location in Philippines, Maldives, Thailand, South Korea, Myanmar, Indonesia