PCI DSS Assessment for Cards Security

All the organizations working online have to take steps to secure data of customers. Cardholder data is the most important of all. The self-assessment questionnaire is the only option to carry security of the businesses. If any business man or companies wants to have security of the data in safe hands, they will have to carry PCI DSS assessment. It will increase the credibility and worth of the business.

A self-assessment questionnaire is a formal report for organization’s compliance. The payment card industry data security standard evaluates the service providers whether they have taken necessary measures to secure card holder documents and data for security posture.

What is a PCI DSS Self Assessment Questionnaire?

PCI DSS self assessment questionnaire is a validation tool to help merchants and business providers to evaluate their reports for compliance. So, SAQ comes with “Yes” or “No” questions that cover all aspects of the organization. It provides security controls and encompasses system configuration, network security and access control. PCI DSS is a formal test for the companies to carry to show their credibility.

Who Needs to Complete PCI DSS SAQ?

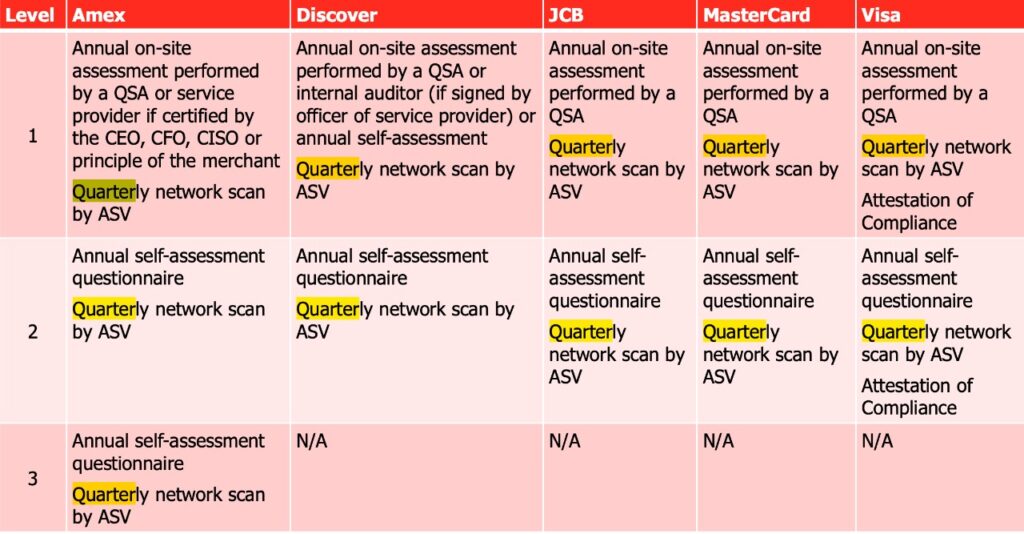

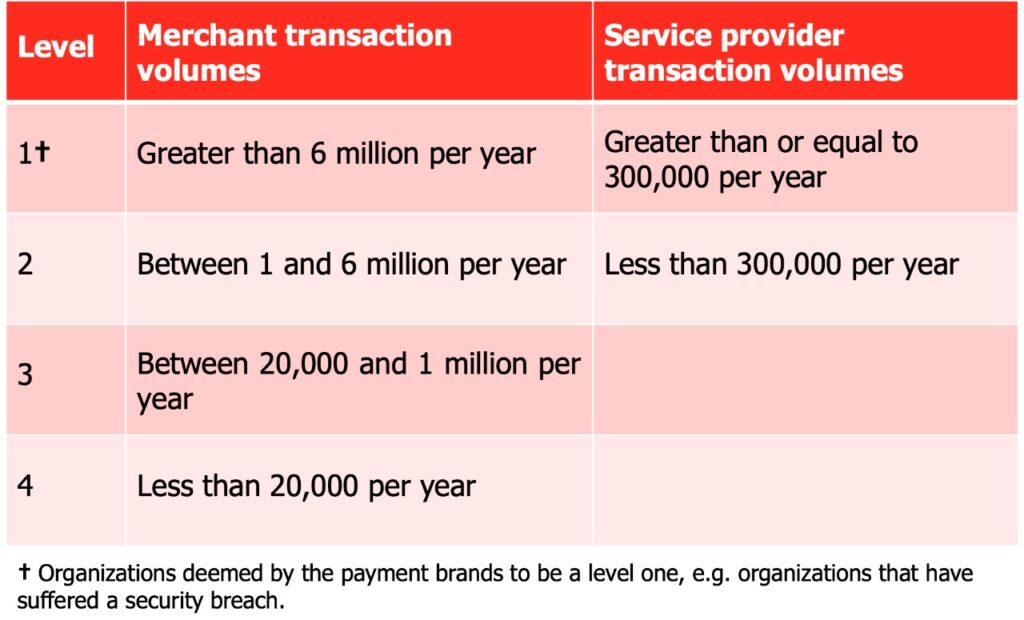

Not each and every organization is eligible for assessment. The service providers or merchants with lower than 5 million annual payment transactions or merchants with less than 300,000 annual payment transactions can submit SAQ for becoming PCI DSS compliant. So, the services providers or organizations that come into this category can take this test and start their assessment for having the badge.

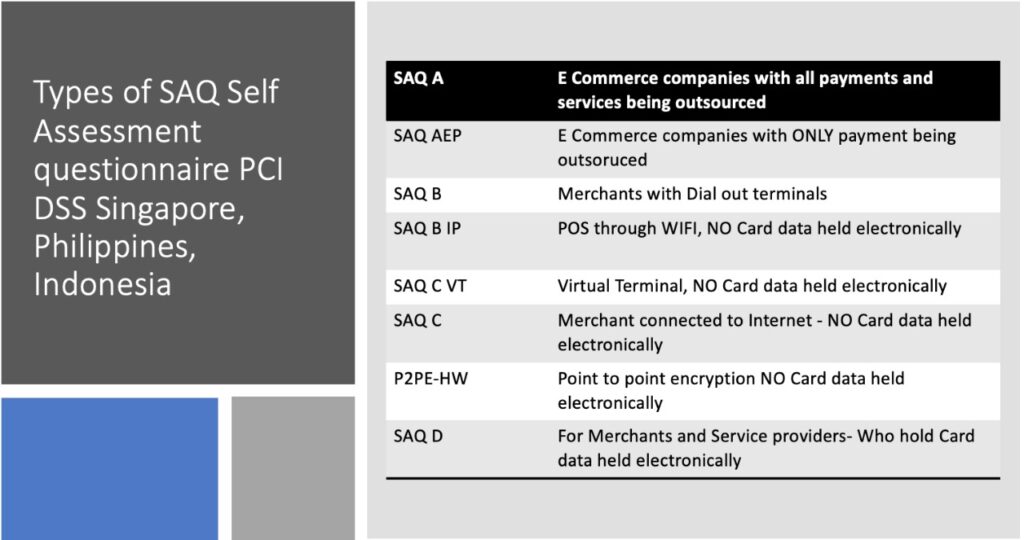

Which PCI SAQ is good for Business?

There are almost 9 types of PCI DSS SAQs. One of them is for service providers and eight tests are for merchants. However, determining that which one best suits your organization depends on two factors. So, you need to study SAQs first to determine which suits your business the most to carry that PCI DSS assessment.

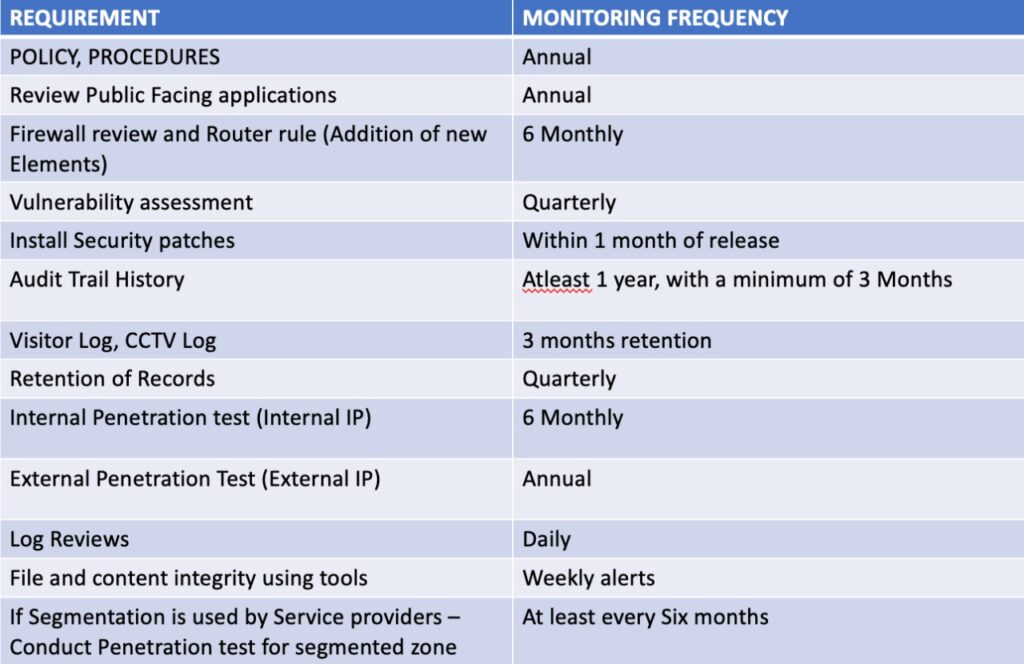

PCI DSS Requirements

More than 300 controls PCI offers in total and it makes it important for all businesses to understand that security is of utmost level. To maintain a secure system, the PCI Security standards council consisting Mastercard, Visa, American Express, Discover and JCB streamline the goals to follow.

- Protects cardholder data for maintaining and installing a firewall.

- After receiving payments from vendors, it change default passwords to secure passwords.

- Protects cardholders by making it secure by other technologies and encryption.

- Ensures that cardholder’s data is encrypted.

- Regular software updates for security vulnerabilities.

- Access to cardholder data on need basis.

- Limits physical data of customers.

- Monitors access to cardholders network and data resources.

- Protects the storing and sharing of customers data with other organizations.

Conclusion

PCI DSS assessment for cards security is a framework with different benefits to follow to secure the data of consumers. It protects data against cyber attacks and frauds. It helps businesses grow faster and encrypt the cardholder data. It also patches the vulnerabilities and limits physical access to cardholders’ data.

For More Information drop an email to [email protected]

Services Offered :- Singapore, Australia, New Zealand , Penang, Batam , Hongkong, Manila, Batangas, Laguna, any location in Philippines, Maldives, Thailand, South Korea, Myanmar, Indonesia