PCI DSS Assessment

The PCI DSS stands for Payment Card Industry Data Security Standard and is widely known for procedures and policies to optimize the security system of credit and debit card transactions. It protects cardholders against misuse of their personal data. PCI DSS was aimed to control cyber security breaches of personal information and to reduce the chances of fraud and handle payment information.

PCI DSS is not any legal regulatory requirement. Moreover, it is the necessary part of businesses to store credit and debit cards payments for future secure transactions.

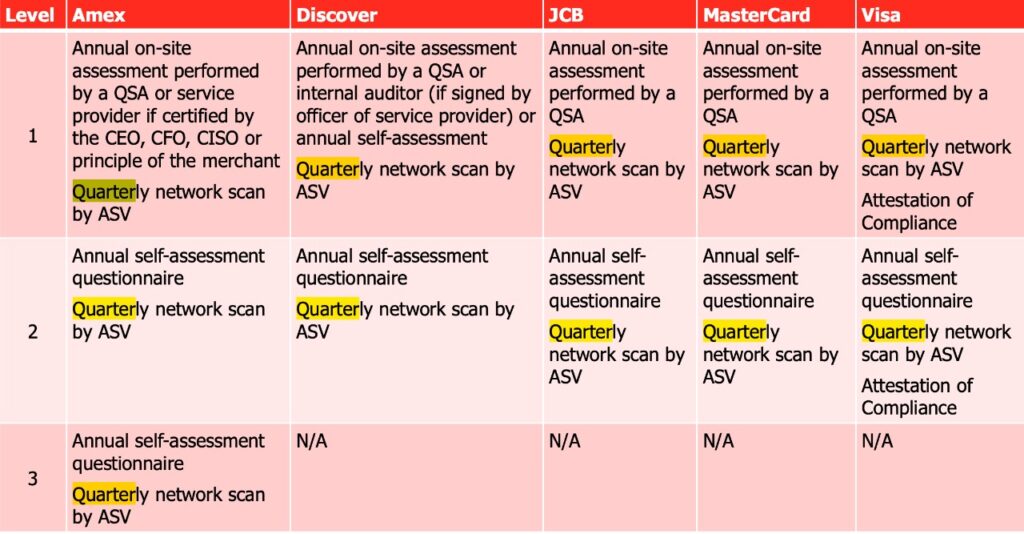

PCI DSS was created by credit card companies: MasterCard, Visa, American Express, JCB and Discover. The payment Card Industry Security Standard Council collectively developed the guidelines for PCI DSS for securing the data of customers.

Purpose of PCI DSS

The prime goal of PCI DSS is to optimize and safeguard the security and personal information of cardholder data. It saves the credit card numbers, security codes and expiration dates from stealing. It helps businesses to minimize the risk of theft of identity, data breaches and fraud.

It optimizes trust among customers and stakeholders because it adopts the best practices when storing, processing and transmitting data.

6 Principles of PCI DSS

- Building Secure Network Systems

All customers require making credit card transactions in some secure network. The security infrastructure must have strong firewalls to be effective enough to offer convenience to cardholders and vendors. Building secure network system is the prime requirement of every valued customer to secure data and personal information.

- Protect Cardholder Data

PCI DSS must secure information of cardholders. Repositories such as mother’s maiden names, birthdates, phone numbers, social security number and mailing addresses must be secure.

- Maintain a Management Program

Card services organizations try to manage program to make their services risk free from malicious hackers. They need to maintain a management program against vulnerabilities and bugs. The debit card services providing organizations regularly update and patch their operation systems to minimize the risk of stealing the data.

- Strong Access Control Measure

All debit card organizations access to system operations and information to restrict and control malicious attacks. Every user is given a specific confidential number or name for saving data of customers. Cardholder data should be secured electronically and physically.

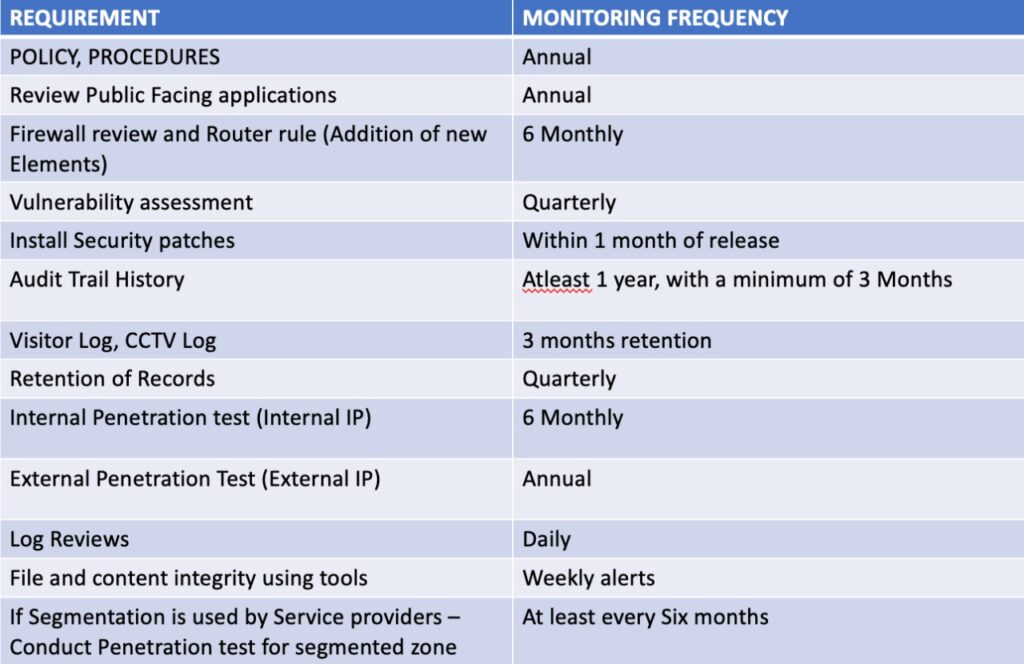

- Regularly Monitor Networks

PCI DSS ensures the regular monitoring of networks to ensure security measures and up to date functioning properly. For instance, antispyware and antivirus programs should offer the latest signatures and definitions. These programs usually scan all applications, exchanged data, storage media and RAM.

- Maintain Security Policy

All participating entities must enforce and maintain formal information security policy for maintaining the data. Sometimes, penalties for noncompliance become necessary. Enforcement measures must be taken to maintain security policy.

Conclusion

PCI DSS Assessment is the best option to adopt for knowing the security level of the card services organizations. These 6 principles are adopted by all the services organizations to store and secure the data of customers. So, PCI DSS assessment plays vital role in increasing the businesses.

For More Information drop an email to [email protected]

Services Offered :- Singapore, Australia, New Zealand , Penang, Batam , Hongkong, Manila, Batangas, Laguna, any location in Philippines, Maldives, Thailand, South Korea, Myanmar, Indonesia